Oxford United’s Financial Statements for the 2021/22 season have today been approved and filed with Companies’ House.

The club promised open communication with supporters and this summary provides a brief review of the financials for the year. Furthermore, the club’s Finance Director Tim Davies will be speaking on the BBC Oxford 5 Minute Fans Forum on 7th April to answer any questions that may arise.

The accounts, which are available in full from Companies House, show Turnover increasing by £1.2M during the year ended 30th June 2022 to £6.9M. With overall cost of sales increasing due to increases in the playing staff costs as well as the costs of the full return to stadia attendance following COVID, the club generated a loss before taxation for the financial year of £4.2m compared with a loss of £3.7m in the previous year.

That loss was fully funded by the ownership group who remain committed to the club and will continue to support it financially. Changes to the structure of the Board as communicated at the start of this season will help with this process.

The club are now putting in place steps to ensure future financial sustainability, which includes the support for the club’s ongoing new stadium development. On this basis, in the short to medium term, this may require further shareholder investment.

Progress was made both on the pitch, where the Men’s team again challenged for the play-offs, narrowly missing out, the Academy continued to flourish and the Women’s team came very close to promotion. There was also progress off the field with commercial revenue growth, despite several headwinds, including the continuing impact of COVID and the challenges facing the entire industry due to the economic climate.

Our on-pitch and financial KPIs were:

| On-pitch KPIs | 2021/22 | 2020/21 |

| League Position | 8th | 6th |

| FA Cup | R1 | R1 |

| Carabao Cup | R2 | R2 |

| Papa John's Trophy | Group Stage | QF |

| Average Attendance | 8,582 | N/A |

Financial KPI

| Financial KPI | 2021/22 | 2020/21 |

| £000 | £000 | |

| Revenue | 6,886 | 5,962 |

| Other operating income | 5 | 302 |

| Loss | (4,161) | (3,738) |

| Net player trading | 866 | 966 |

Our summarised income statement is shown below:

| 2022 | 2021 | |

| As restated | ||

| £ | £ | |

| Turnover | 6,886,051 | 5,962,767 |

| Cost of Sales | (7,630,733) | (6,714,665) |

| Gross Loss | (744,682) | (751,898) |

| Administrative expenses | (4,254,222) | (4,151,960) |

| Other operating income | 5,394 | 302,077 |

| Profit on disposal of players | 1,632,253 | 1,841,905 |

| Amortisation of player contracts | (430,057) | (312,938) |

| Payments in respect of player contracts | (336,040) | (563,901) |

| Operating Loss | (4,127,354) | (3,636,715) |

| Interest payable and similar expenses | (33,752) | (10,1626) |

| Loss before taxation | (4,161,106) | (3,738,341) |

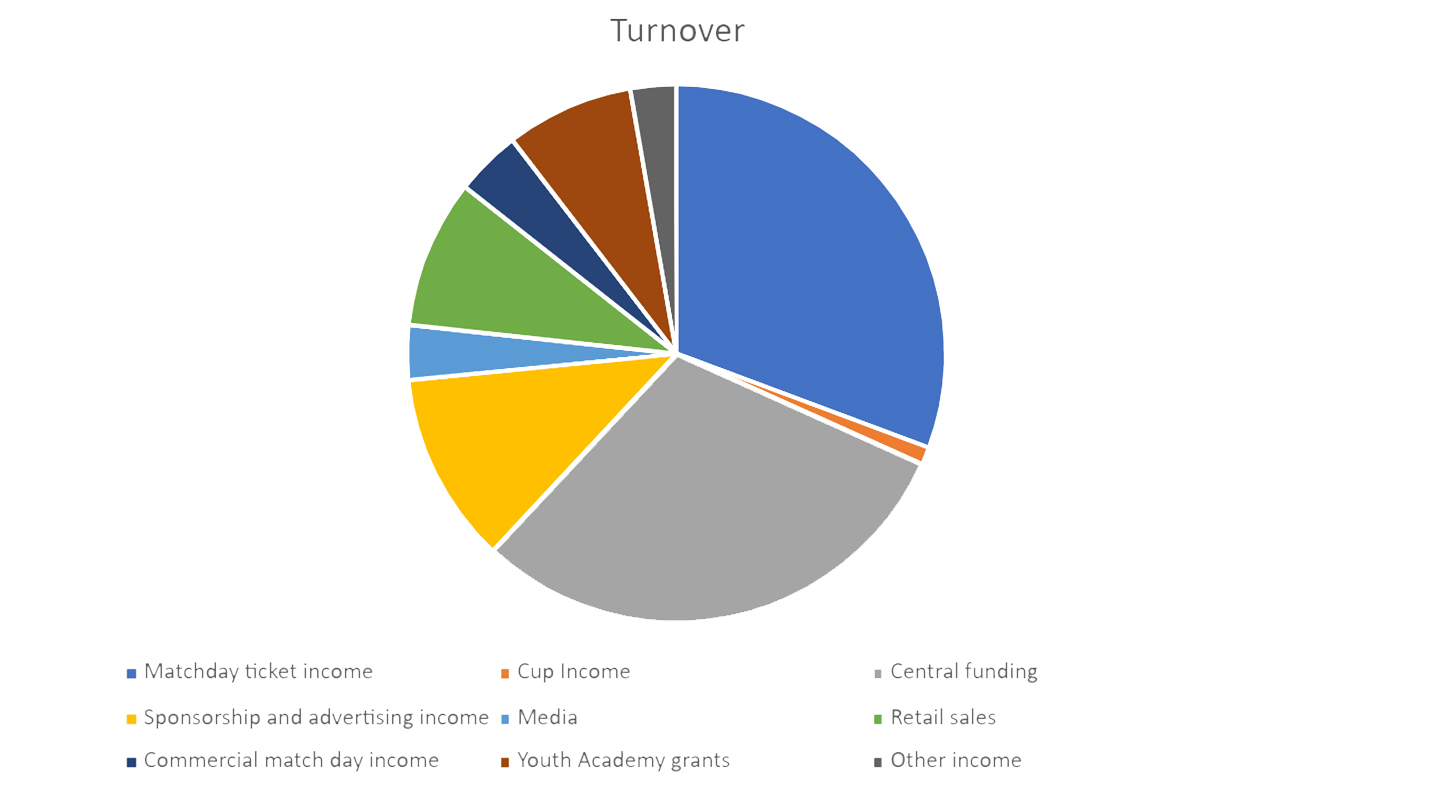

Our turnover is analysed as per the chart below;

Although we achieved our highest points total for many years, we finished just outside the play-offs in Sky Bet League 1 and unlike in previous seasons there was no ‘cup run’ to boost our matchday revenues. Despite that, our average attendance was strong at 8,582 and other sources of income increased such as retail and sponsorships.

Comparison with the previous season is problematic. There were no regular crowds in the 2020/21 season due to COVID but we benefitted from extra iFollow receipts and a Premier League grant which helped offset some of the COVID impacts. Other operating income was down due to a £300k reduction in COVID job-retention support while our cost of sales increased due to the full restart after COVID, impacting matchday costs and also due to investment in our playing squad.

Our main player sale in the year was Rob Atkinson to Bristol City, which enabled us to invest in our playing squad and our infrastructure at the Training Ground.

There was investment in fixed assets relating mostly to a new roof at the training ground with a new pitch and irrigation system for the pitches, continuing the improvement programme for all of our training facilities and demonstrating the club’s commitment to investing in infrastructure. Debtors rose due to instalments due on the sale of Rob Atkinson and also seasonal sponsorships invoiced in June 22, while an increase in creditors related to the ongoing funding of the club by our shareholders as well as deferred income re 22/23 Season Tickets and Seasonal Sponsorships.

The loss for the year of £4.2m was funded by our Shareholders who are our main creditor. During the year the Shareholders also converted £1.5m of this funding into equity.

With the changes to the shareholding group after the year end the club is now well placed for the future. However, this is, and was always intended to be a long term project and whilst the current league position at the date of writing is far from ideal, this does not alter the long term plans for the club.